2025 Financial Year Calendar Australia

Related Articles: 2025 Financial Year Calendar Australia

- 2025 Calendar Printable PDF: A Comprehensive Guide To Planning Your Future

- September 2025 Calendar Month

- A3 Calendar 2025 Template: A Comprehensive Guide To Customization And Design

- Free Google Calendar 2025: The Ultimate Guide To Planning Your Year

- The Sierra Club 2012 Engagement Calendar: A Visual Journey To Protect The Planet

Introduction

In this auspicious occasion, we are delighted to delve into the intriguing topic related to 2025 Financial Year Calendar Australia. Let’s weave interesting information and offer fresh perspectives to the readers.

Table of Content

Video about 2025 Financial Year Calendar Australia

2025 Financial Year Calendar Australia

Introduction

The Australian financial year (FY) runs from July 1 to June 30. This is different from the calendar year, which runs from January 1 to December 31. The financial year is used by businesses and the government to track their income and expenses.

Key Dates

The following are some key dates in the 2025 financial year calendar:

- July 1, 2025: Start of the financial year

- June 30, 2026: End of the financial year

- October 31, 2025: Deadline for lodging income tax returns

- November 15, 2025: Deadline for paying income tax

- February 28, 2026: Deadline for lodging business activity statements (BAS)

- May 15, 2026: Deadline for paying company tax

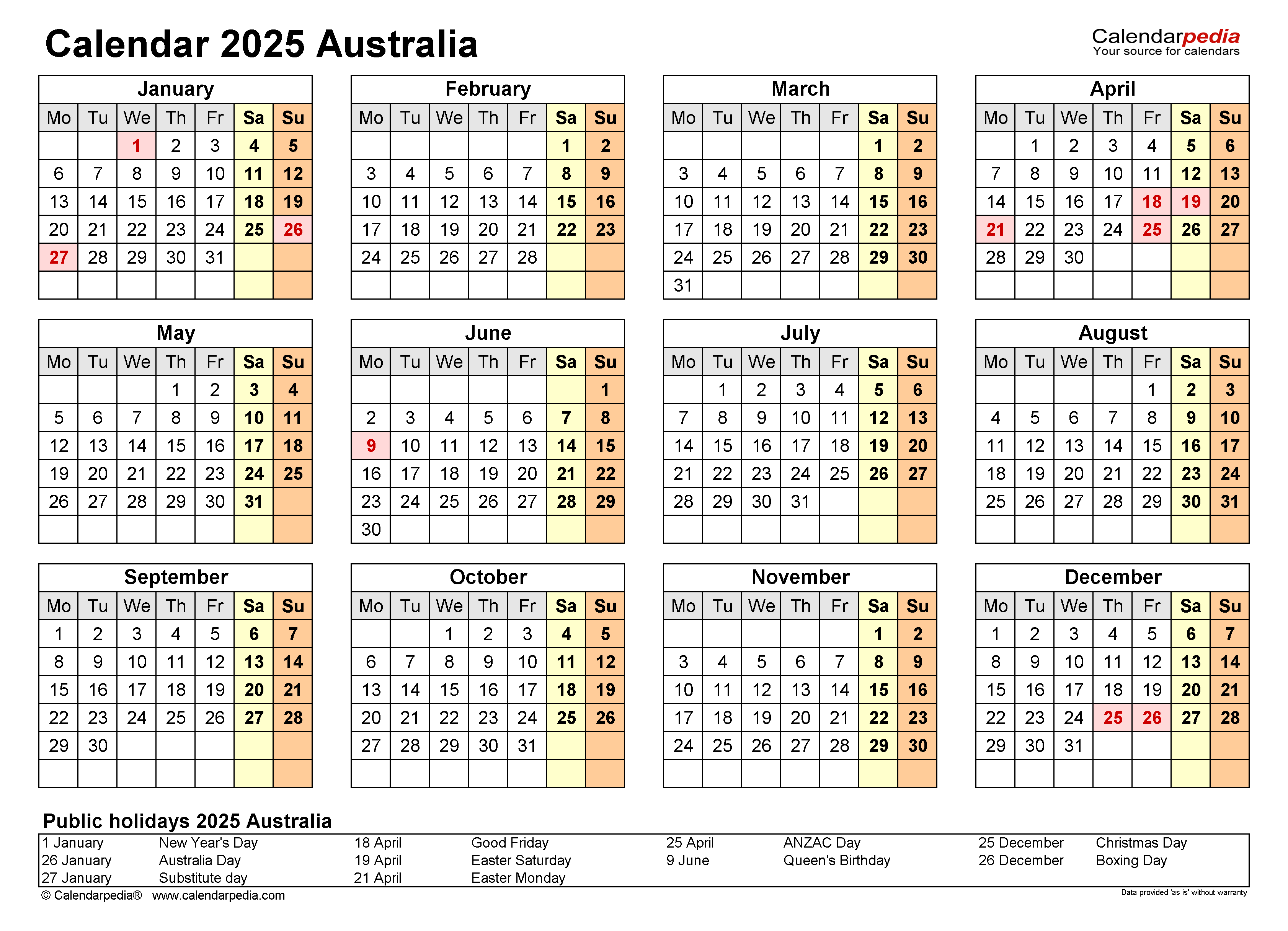

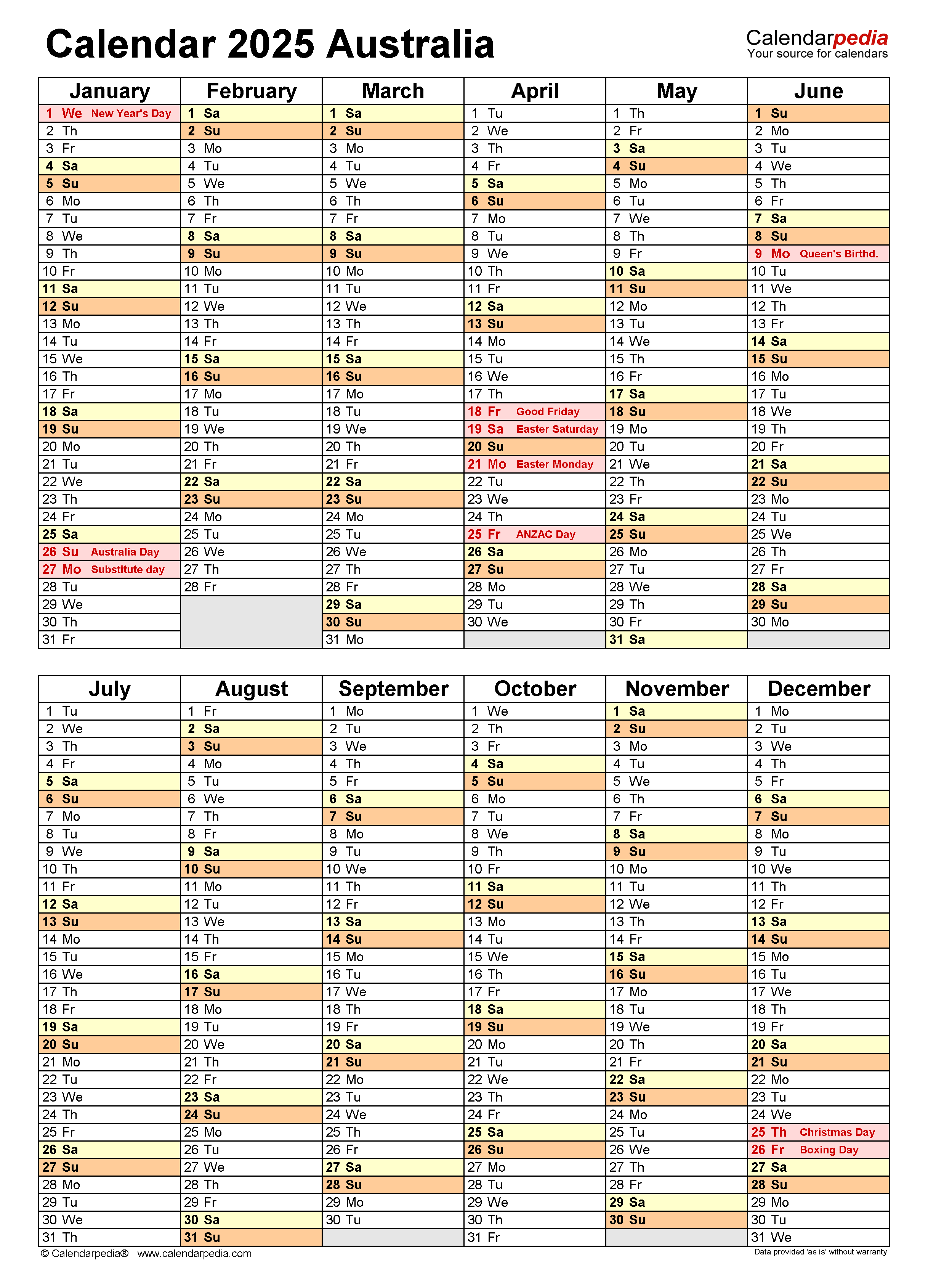

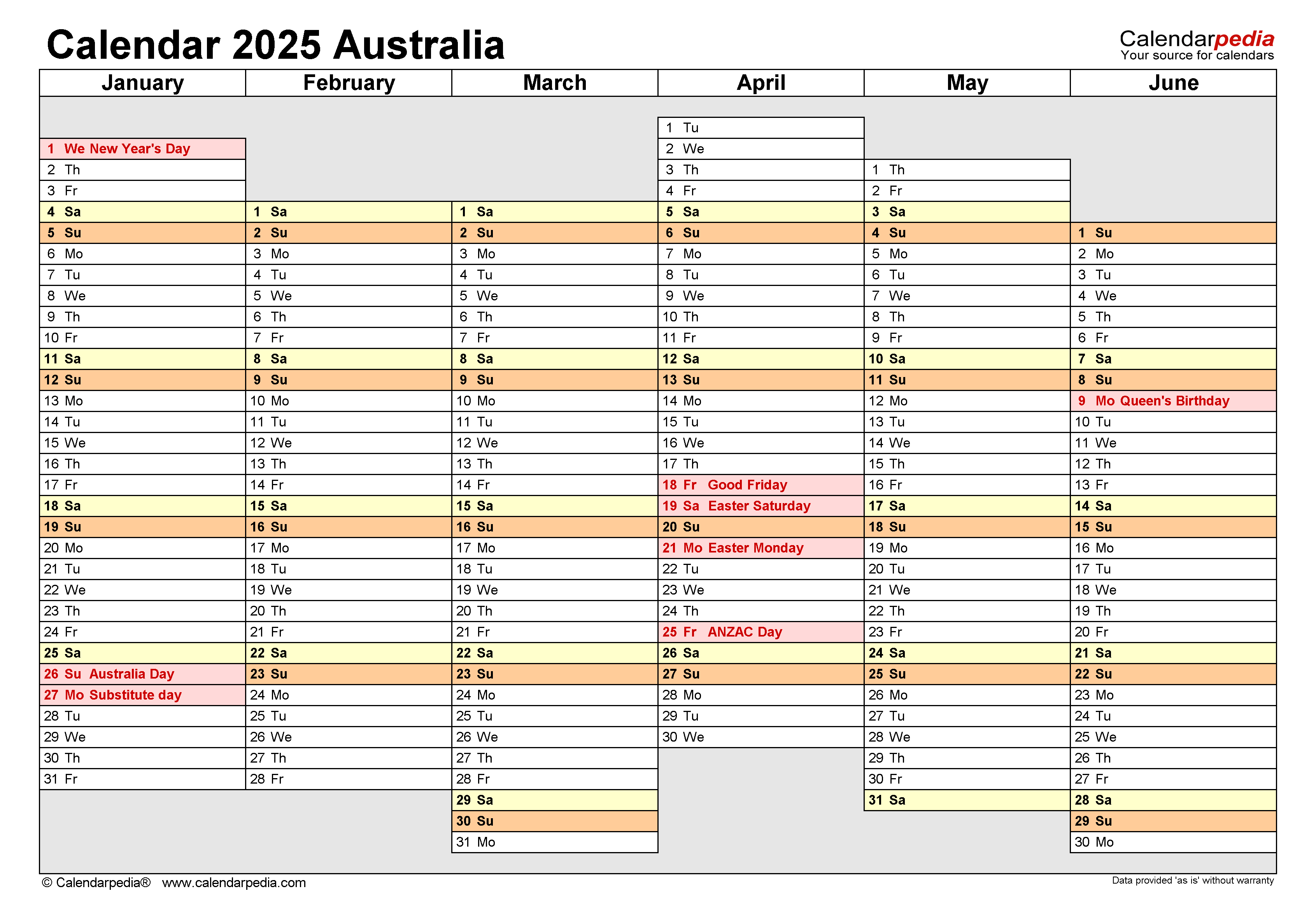

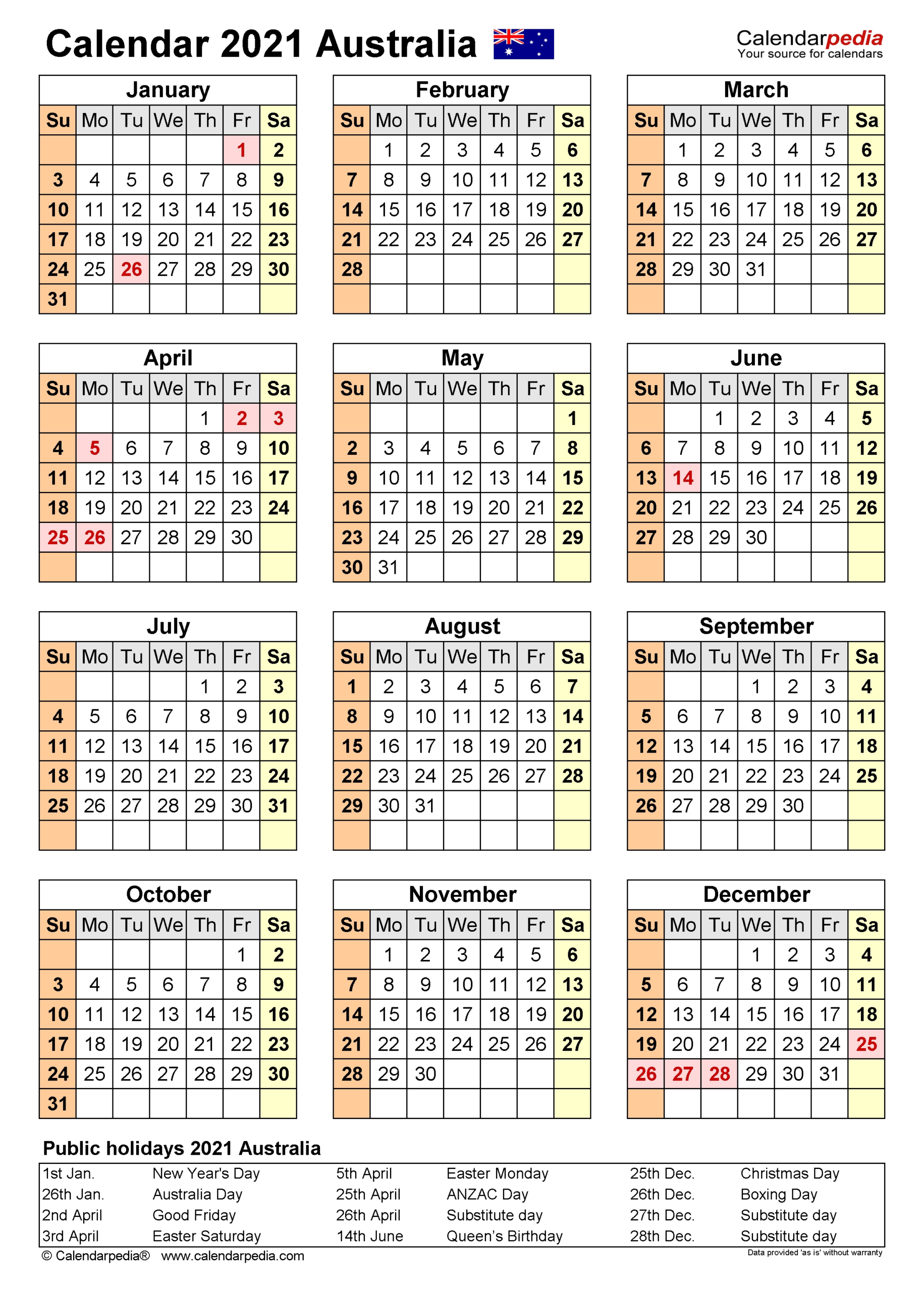

Public Holidays

The following public holidays fall within the 2025 financial year:

- New Year’s Day: January 1, 2025

- Australia Day: January 26, 2025

- Good Friday: April 10, 2025

- Easter Monday: April 13, 2025

- Anzac Day: April 25, 2025

- Labour Day: May 1, 2025

- Queen’s Birthday: June 9, 2025

- Christmas Day: December 25, 2025

- Boxing Day: December 26, 2025

Tax Deadlines

The following tax deadlines fall within the 2025 financial year:

- October 31, 2025: Deadline for lodging income tax returns

- November 15, 2025: Deadline for paying income tax

- February 28, 2026: Deadline for lodging business activity statements (BAS)

- May 15, 2026: Deadline for paying company tax

Business Deadlines

The following business deadlines fall within the 2025 financial year:

- February 28, 2026: Deadline for lodging business activity statements (BAS)

- May 15, 2026: Deadline for paying company tax

Other Important Dates

The following other important dates fall within the 2025 financial year:

- June 30, 2025: End of the financial year

- July 1, 2025: Start of the new financial year

Conclusion

The 2025 financial year calendar is an important tool for businesses and individuals in Australia. It provides a clear overview of key dates and deadlines throughout the year. By being aware of these dates, you can ensure that you meet your obligations on time and avoid any penalties.

Closure

Thus, we hope this article has provided valuable insights into 2025 Financial Year Calendar Australia. We appreciate your attention to our article. See you in our next article!