Earnings Calendar: February 7, 2025

Related Articles: Earnings Calendar: February 7, 2025

- August 2025 Calendar Word: A Comprehensive Guide

- Academic Calendar 2025-2026

- Hawaii State Holidays 2025 Calendar

- Free Printable Monthly Calendar January 2025: Plan Your Month Effectively

- Calendar Holidays For 2025: A Comprehensive Guide

Introduction

With great pleasure, we will explore the intriguing topic related to Earnings Calendar: February 7, 2025. Let’s weave interesting information and offer fresh perspectives to the readers.

Table of Content

Video about Earnings Calendar: February 7, 2025

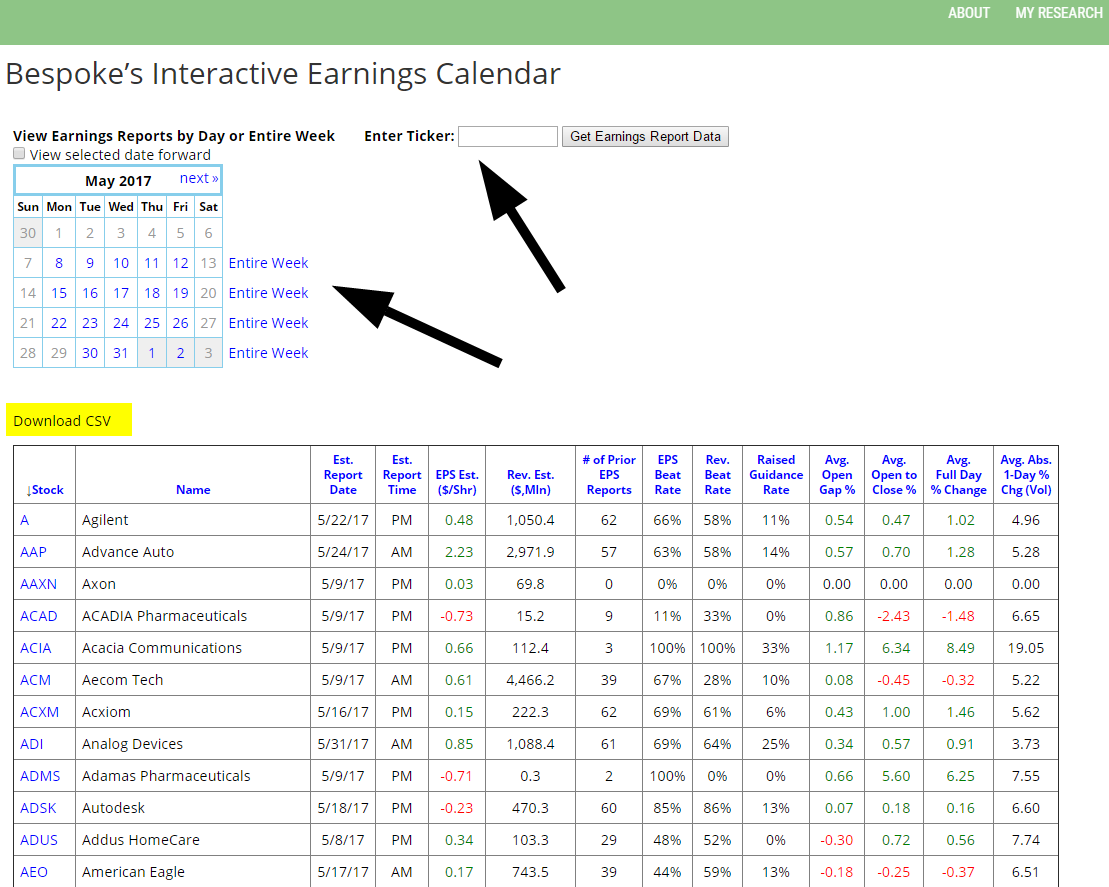

Earnings Calendar: February 7, 2025

Before the Bell:

-

6:00 AM ET:

- AMC Entertainment (AMC): The movie theater chain is expected to report a decline in revenue due to the ongoing impact of the COVID-19 pandemic. Analysts forecast a loss per share of $0.15.

- Chipotle Mexican Grill (CMG): The fast-casual restaurant is anticipated to deliver strong earnings, driven by increased customer demand and menu innovation. The consensus EPS estimate is $6.05.

- CVS Health (CVS): The pharmacy giant is projected to report a slight increase in revenue and earnings, supported by its growing healthcare services segment. The average EPS forecast is $2.08.

-

6:30 AM ET:

- General Electric (GE): The industrial conglomerate is expected to show improvement in its earnings, reflecting cost-cutting measures and increased demand for its products. Analysts anticipate an EPS of $0.12.

- Halliburton (HAL): The oilfield services provider is forecast to report a loss due to the ongoing weakness in the energy sector. The consensus EPS estimate is -$0.10.

- Lockheed Martin (LMT): The defense contractor is projected to deliver solid earnings, driven by increased government spending on defense programs. The average EPS forecast is $7.05.

After the Bell:

-

4:00 PM ET:

- Advanced Micro Devices (AMD): The semiconductor manufacturer is expected to report strong earnings, driven by the growing demand for its chips in data centers and gaming consoles. The consensus EPS estimate is $1.35.

- Boeing (BA): The aerospace giant is anticipated to show improvement in its earnings, reflecting increased aircraft deliveries and cost reductions. Analysts forecast an EPS of $2.50.

- Caterpillar (CAT): The construction equipment manufacturer is projected to report a decline in earnings due to the slowdown in the global construction sector. The average EPS estimate is $3.10.

-

4:30 PM ET:

- Coca-Cola (KO): The beverage giant is expected to report stable earnings, supported by its strong brand portfolio and international growth. The consensus EPS estimate is $0.56.

- Dow (DOW): The chemical company is anticipated to deliver strong earnings, driven by increased demand for its products in the construction and packaging industries. Analysts forecast an EPS of $2.20.

- Intel (INTC): The semiconductor manufacturer is projected to report a decline in earnings due to the ongoing supply chain issues and increased competition. The average EPS estimate is $1.05.

-

5:00 PM ET:

- Microsoft (MSFT): The tech giant is expected to report strong earnings, driven by the growth of its cloud computing and software businesses. The consensus EPS estimate is $2.50.

- Nike (NKE): The sportswear giant is anticipated to deliver solid earnings, supported by increased demand for its products in both domestic and international markets. Analysts forecast an EPS of $1.25.

- Tesla (TSLA): The electric vehicle manufacturer is projected to report strong earnings, driven by the growing demand for its cars and the expansion of its production capacity. The average EPS estimate is $2.00.

Earnings Call Highlights:

AMC Entertainment:

- CEO Adam Aron emphasized the challenges faced by the movie theater industry during the pandemic but expressed optimism about the future.

- The company announced plans to expand its premium seating options and invest in new technologies to enhance the customer experience.

Chipotle Mexican Grill:

- CEO Brian Niccol highlighted the strong performance of the company’s digital ordering and delivery channels.

- Chipotle announced its intention to open 200 new restaurants in 2025, focusing on smaller, drive-thru locations.

CVS Health:

- CEO Karen Lynch discussed the company’s strategy to expand its healthcare services offerings, including primary care and behavioral health.

- CVS Health announced a partnership with Amazon to offer prescription delivery and other healthcare services through Amazon’s platform.

Advanced Micro Devices:

- CEO Lisa Su expressed confidence in the company’s long-term growth prospects, driven by the increasing adoption of its chips in various industries.

- AMD announced plans to invest heavily in research and development to maintain its competitive advantage.

Boeing:

- CEO Dave Calhoun provided an update on the company’s production ramp-up for the 737 MAX aircraft and its plans to address supply chain challenges.

- Boeing announced a new order from Southwest Airlines for 100 737 MAX aircraft.

Microsoft:

- CEO Satya Nadella emphasized the company’s focus on cloud computing, artificial intelligence, and security.

- Microsoft announced the release of new cloud-based products and services, including Azure OpenAI Service and Viva Engage.

Tesla:

- CEO Elon Musk discussed the company’s plans to increase production capacity and expand its product lineup.

- Tesla announced the launch of the Cybertruck electric pickup truck and the Semi electric truck.

Market Reaction:

- The overall market reacted positively to the earnings reports, with major indices showing gains.

- Stocks that beat analyst expectations, such as Chipotle Mexican Grill and Advanced Micro Devices, saw significant price increases.

- Companies that missed estimates, such as General Electric and Halliburton, experienced declines in their stock prices.

Analysts’ Commentary:

- "The earnings season is off to a solid start, with many companies delivering strong results," said David Bianco, an analyst at Deutsche Bank. "Investors should remain optimistic about the outlook for the market."

- "We expect to see continued volatility in the tech sector as companies navigate the challenges of supply chain disruptions and increased competition," said Mark Mahaney, an analyst at Evercore ISI.

- "The healthcare sector is poised for growth, driven by the aging population and the increasing demand for healthcare services," said Leerink Partners analyst Ana Gupte.

Closure

Thus, we hope this article has provided valuable insights into Earnings Calendar: February 7, 2025. We hope you find this article informative and beneficial. See you in our next article!