EY GDS Calendar 2025: A Comprehensive Guide to Tax Deadlines and Compliance Requirements

Related Articles: EY GDS Calendar 2025: A Comprehensive Guide to Tax Deadlines and Compliance Requirements

- Printable Moon Phase Calendar 2025: A Comprehensive Guide To Lunar Cycles

- School Calendar Of Activities 2025-2026

- Qatar Islamic Calendar 2023 To 2025: A Comprehensive Guide

- September 2025 Calendar By Week

- Arabic-English Calendar 2025: A Comprehensive Guide

Introduction

With great pleasure, we will explore the intriguing topic related to EY GDS Calendar 2025: A Comprehensive Guide to Tax Deadlines and Compliance Requirements. Let’s weave interesting information and offer fresh perspectives to the readers.

Table of Content

Video about EY GDS Calendar 2025: A Comprehensive Guide to Tax Deadlines and Compliance Requirements

EY GDS Calendar 2025: A Comprehensive Guide to Tax Deadlines and Compliance Requirements

The EY Global Delivery Services (GDS) Calendar 2025 provides a comprehensive overview of key tax deadlines and compliance requirements for businesses operating in various jurisdictions around the world. This calendar is an invaluable resource for tax professionals, accountants, and business leaders who need to stay up-to-date on the latest tax regulations and reporting requirements.

Key Features of the EY GDS Calendar 2025

- Comprehensive coverage: The calendar includes tax deadlines and compliance requirements for over 150 countries and jurisdictions.

- Timely updates: The calendar is updated regularly to reflect the latest changes in tax laws and regulations.

- Easy-to-use format: The calendar is presented in a clear and concise format, making it easy to navigate and find the information you need.

- Multiple language options: The calendar is available in multiple languages, including English, Spanish, French, German, and Chinese.

Benefits of Using the EY GDS Calendar 2025

- Avoid penalties and interest charges: By staying informed of tax deadlines and compliance requirements, you can avoid costly penalties and interest charges.

- Improve tax planning and compliance: The calendar helps you plan your tax strategies and ensure compliance with all applicable tax laws and regulations.

- Enhance business operations: By understanding the tax implications of your business activities, you can make informed decisions that optimize your operations and minimize your tax burden.

- Gain a competitive advantage: Staying up-to-date on tax regulations can give your business a competitive advantage by enabling you to identify opportunities and avoid potential pitfalls.

Key Tax Deadlines and Compliance Requirements

The EY GDS Calendar 2025 includes a wide range of tax deadlines and compliance requirements, including:

- Corporate income tax: Due dates for filing corporate income tax returns and paying taxes.

- Personal income tax: Due dates for filing personal income tax returns and paying taxes.

- Value-added tax (VAT): Due dates for filing VAT returns and paying taxes.

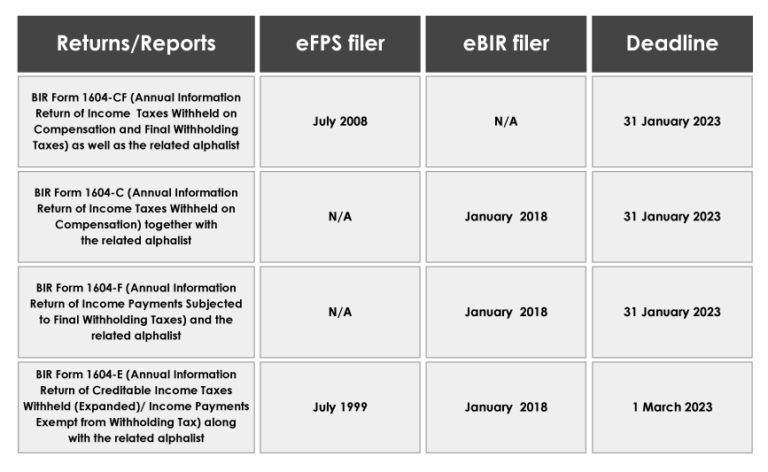

- Withholding tax: Due dates for withholding taxes on payments to employees, contractors, and other parties.

- Social security contributions: Due dates for making social security contributions for employees.

- Transfer pricing: Compliance requirements for businesses engaged in cross-border transactions.

- Tax audits: Timeframes for tax audits and the procedures for responding to audit notices.

Additional Features

In addition to the core tax deadlines and compliance requirements, the EY GDS Calendar 2025 also includes the following features:

- Country-specific tax guides: Links to detailed tax guides for each country or jurisdiction.

- EY contacts: Contact information for EY professionals in each country or jurisdiction.

- Useful resources: Links to other resources, such as tax calculators and online tax filing portals.

Conclusion

The EY GDS Calendar 2025 is an essential tool for tax professionals, accountants, and business leaders who need to stay up-to-date on the latest tax regulations and compliance requirements around the world. By using this calendar, you can ensure that your business meets all its tax obligations and avoids costly penalties and interest charges.

Closure

Thus, we hope this article has provided valuable insights into EY GDS Calendar 2025: A Comprehensive Guide to Tax Deadlines and Compliance Requirements. We hope you find this article informative and beneficial. See you in our next article!