HR Compliance Calendar 2025: A Comprehensive Guide for HR Professionals

Related Articles: HR Compliance Calendar 2025: A Comprehensive Guide for HR Professionals

- February 2025 Calendar Printable Free PDF: Plan Your Month Effectively

- Baldwin County School Calendar 2025-2026: A Comprehensive Guide For Students, Parents, And Educators

- 2025 Yearly Calendar With Holidays

- 2025-2026 School Year Calendar For Pinellas County Schools

- 2025 Calendar HD: A Comprehensive Guide To The Year’s Events

Introduction

With great pleasure, we will explore the intriguing topic related to HR Compliance Calendar 2025: A Comprehensive Guide for HR Professionals. Let’s weave interesting information and offer fresh perspectives to the readers.

Table of Content

Video about HR Compliance Calendar 2025: A Comprehensive Guide for HR Professionals

HR Compliance Calendar 2025: A Comprehensive Guide for HR Professionals

Introduction

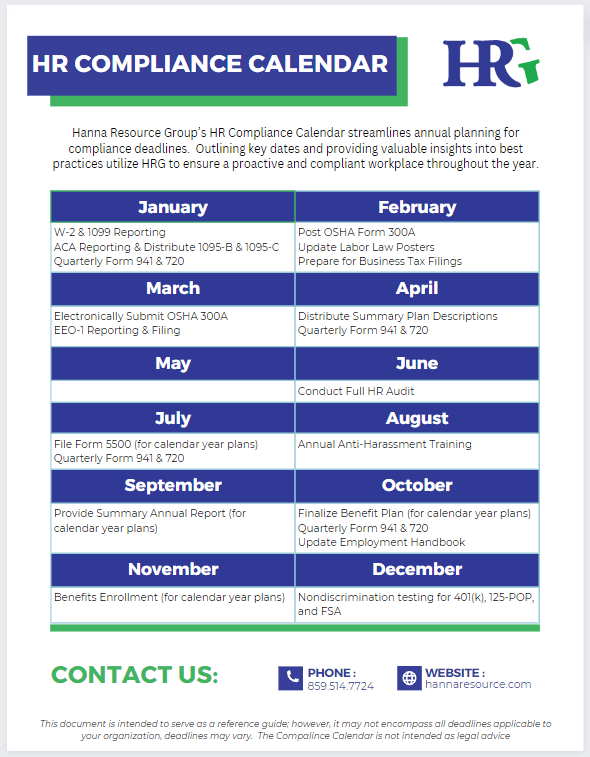

Navigating the ever-evolving landscape of human resources (HR) compliance can be a daunting task. To ensure compliance with federal and state regulations, HR professionals must stay abreast of upcoming deadlines and requirements. This comprehensive HR Compliance Calendar for 2025 provides a detailed overview of key compliance obligations to help organizations avoid costly penalties and legal risks.

January

-

January 1:

- New Year’s Day (Federal holiday)

- Submit W-2s to employees and the Social Security Administration (SSA)

-

January 31:

- File Form 941 (Employer’s Quarterly Federal Tax Return) if you have employees

February

-

February 15:

- Deadline for employers with 50 or more employees to file Form W-2 (Copy A) with the SSA

-

February 28:

- Deadline to file Form 1095-C (Employer-Provided Health Insurance Offer and Coverage) for employees

March

-

March 15:

- Deadline to file Form 1099-MISC (Miscellaneous Income) for non-employees

-

March 31:

- Deadline to file Form 940 (Employer’s Annual Federal Unemployment Tax Return)

April

-

April 15:

- Deadline to file federal income taxes (Form 1040)

May

-

May 1:

- Deadline for employers with 100 or more employees to submit EEO-1 (Employer Information Report)

-

May 15:

- Deadline to file Form 941 (Employer’s Quarterly Federal Tax Return) if you have employees

June

-

June 15:

- Deadline to file Form 944 (Employer’s Annual Federal Tax Return for Household Employees)

-

June 30:

- Deadline to file Form 1094-C (Transmittal of Employer-Provided Health Insurance Offer and Coverage Information Returns)

July

-

July 1:

- Deadline for employers with 50 or more employees to file EEO-1 Component 2 (Compensation Data Report)

-

July 15:

- Deadline to file Form 941 (Employer’s Quarterly Federal Tax Return) if you have employees

August

-

August 1:

- Deadline for employers with 100 or more employees to submit EEO-1 Component 1 (Job Category Data Report)

-

August 15:

- Deadline to file Form 943 (Employer’s Annual Federal Tax Return for Agricultural Employees)

September

-

September 15:

- Deadline to file Form 941 (Employer’s Quarterly Federal Tax Return) if you have employees

October

-

October 15:

- Deadline to file Form 945 (Annual Return of Withheld Federal Income Tax)

-

October 31:

- Deadline to provide employees with Form W-2 (Copy B)

November

-

November 15:

- Deadline to file Form 941 (Employer’s Quarterly Federal Tax Return) if you have employees

December

-

December 15:

- Deadline to file Form 942 (Employer’s Annual Federal Income Tax Return for Withheld Income Tax on Nonresident Aliens and Foreign Corporations)

-

December 31:

- Deadline to file Form 1096 (Annual Summary and Transmittal of U.S. Information Returns)

Additional Compliance Obligations

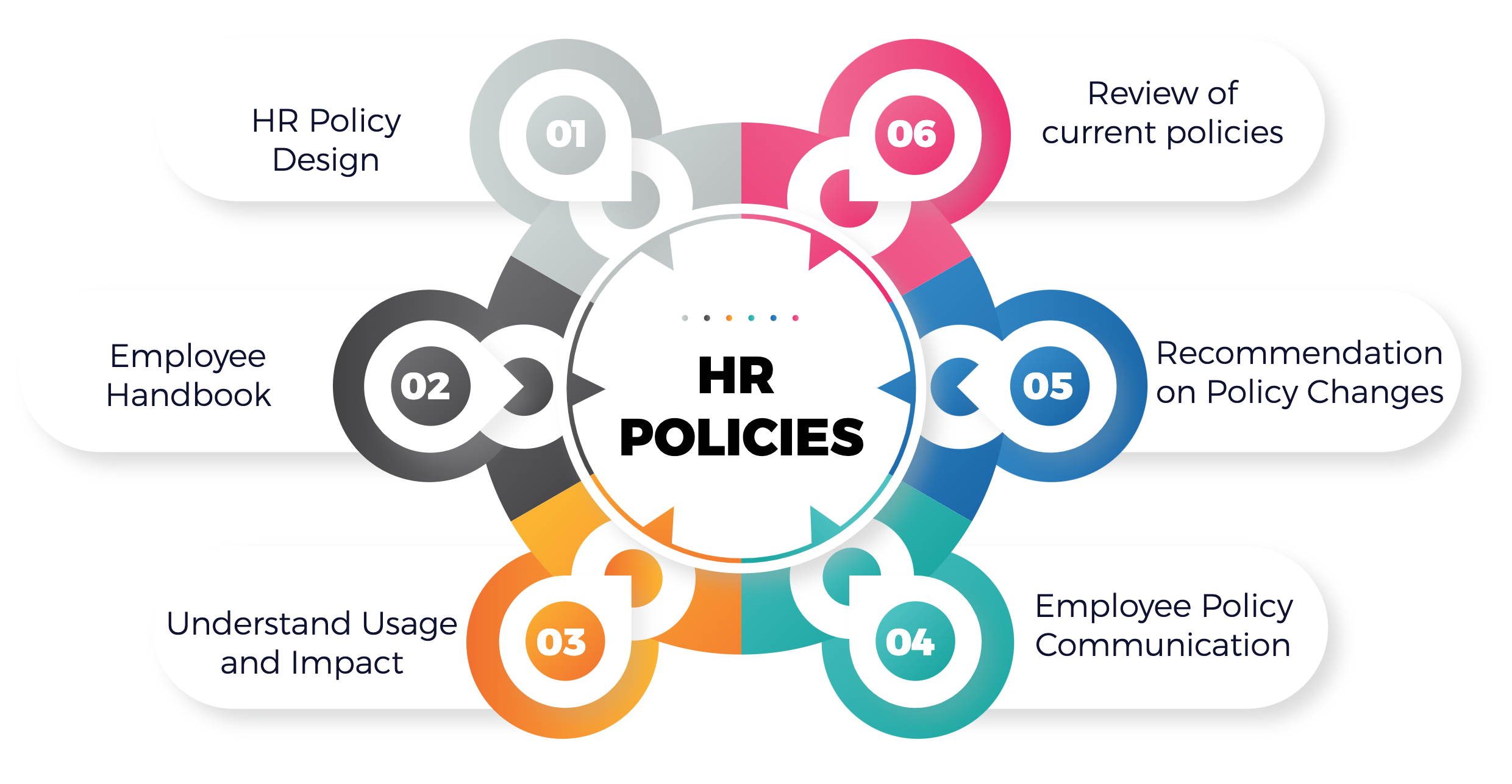

In addition to the deadlines listed above, HR professionals should also be aware of the following ongoing compliance obligations:

-

Employee Benefits:

- Comply with the Affordable Care Act (ACA) by providing employees with access to affordable health insurance coverage

- Manage employee retirement plans, such as 401(k)s and pensions

-

Workplace Safety:

- Maintain a safe and healthy workplace by complying with Occupational Safety and Health Administration (OSHA) regulations

- Provide employees with training on workplace safety and health hazards

-

Anti-Discrimination and Harassment:

- Create and maintain a workplace free from discrimination and harassment

- Conduct regular training for employees on anti-discrimination and harassment policies

-

Wage and Hour Compliance:

- Ensure that employees are paid at least minimum wage and overtime pay as required by law

- Keep accurate records of employee hours worked

Conclusion

The HR Compliance Calendar for 2025 provides a comprehensive overview of key compliance obligations for HR professionals. By staying abreast of these deadlines and requirements, organizations can minimize the risk of costly penalties, legal challenges, and reputational damage. It is essential for HR departments to prioritize compliance and work closely with legal counsel to ensure that they are fulfilling their obligations effectively.

![]()

![HR Compliance Checklist: A Brief Guide [+ Templates] - Venngage](https://venngage-wordpress.s3.amazonaws.com/uploads/2022/01/HR-Compliance-Checklist-First-Page-Example-730x945.png)

.png)

Closure

Thus, we hope this article has provided valuable insights into HR Compliance Calendar 2025: A Comprehensive Guide for HR Professionals. We hope you find this article informative and beneficial. See you in our next article!