IPSD 204, 205, and 206: Calendar for 2025 and 2026

Related Articles: IPSD 204, 205, and 206: Calendar for 2025 and 2026

- Calendar With Holidays For 2025

- Unveiling The Enchanting Realm Of Kiehl’s Advent Calendar 2025 USA

- Free Printable Monthly Calendar January 2025: Plan Your Month Effectively

- OC Calendar 2025 Design: A Visual Masterpiece

- Earnings Calendar: February 7, 2025

Introduction

With enthusiasm, let’s navigate through the intriguing topic related to IPSD 204, 205, and 206: Calendar for 2025 and 2026. Let’s weave interesting information and offer fresh perspectives to the readers.

Table of Content

Video about IPSD 204, 205, and 206: Calendar for 2025 and 2026

IPSD 204, 205, and 206: Calendar for 2025 and 2026

Introduction

The International Public Sector Accounting Standards Board (IPSASB) is an independent, private-sector body that develops and approves International Public Sector Accounting Standards (IPSASs). IPSASs are designed to improve the quality of financial reporting by public sector entities around the world.

IPSAS 204, 205, and 206 are three new IPSASs that will be effective for periods beginning on or after January 1, 2025. These IPSASs will replace IPSAS 1, 2, and 17, respectively.

IPSAS 204: Presentation of Financial Statements

IPSAS 204 establishes the requirements for the presentation of financial statements by public sector entities. The objective of IPSAS 204 is to ensure that financial statements are presented in a manner that is clear, concise, and informative.

IPSAS 204 includes the following key requirements:

- Financial statements must be presented in accordance with the accrual basis of accounting.

- Financial statements must be presented on a going concern basis.

- Financial statements must be presented using the single entity approach.

- Financial statements must be presented in a comparative format.

- Financial statements must include notes that provide additional information about the entity’s financial position and performance.

IPSAS 205: Financial Reporting by Public Sector Entities

IPSAS 205 establishes the requirements for the preparation of financial statements by public sector entities. The objective of IPSAS 205 is to ensure that financial statements are prepared in accordance with high-quality accounting principles.

IPSAS 205 includes the following key requirements:

- Public sector entities must prepare financial statements in accordance with IPSASs.

- Public sector entities must use the accrual basis of accounting.

- Public sector entities must use the going concern basis of accounting.

- Public sector entities must use the single entity approach.

- Public sector entities must prepare financial statements on a comparative basis.

IPSAS 206: Consolidated and Separate Financial Statements

IPSAS 206 establishes the requirements for the preparation of consolidated and separate financial statements by public sector entities. The objective of IPSAS 206 is to ensure that consolidated and separate financial statements are prepared in accordance with high-quality accounting principles.

IPSAS 206 includes the following key requirements:

- Public sector entities must prepare consolidated financial statements if they control one or more other entities.

- Public sector entities must prepare separate financial statements if they are not controlled by another entity.

- Consolidated and separate financial statements must be prepared in accordance with IPSASs.

- Consolidated and separate financial statements must be presented in a comparative format.

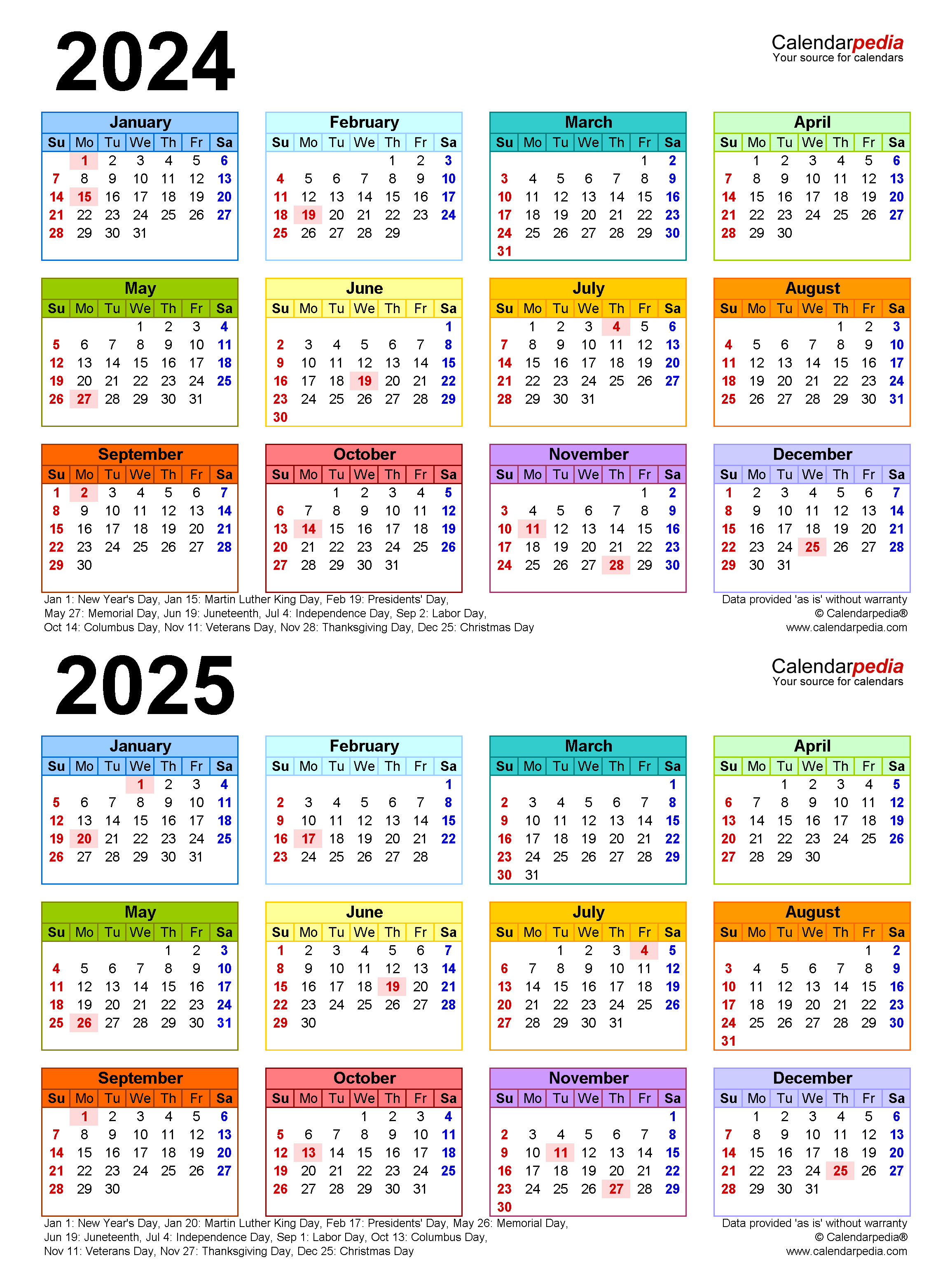

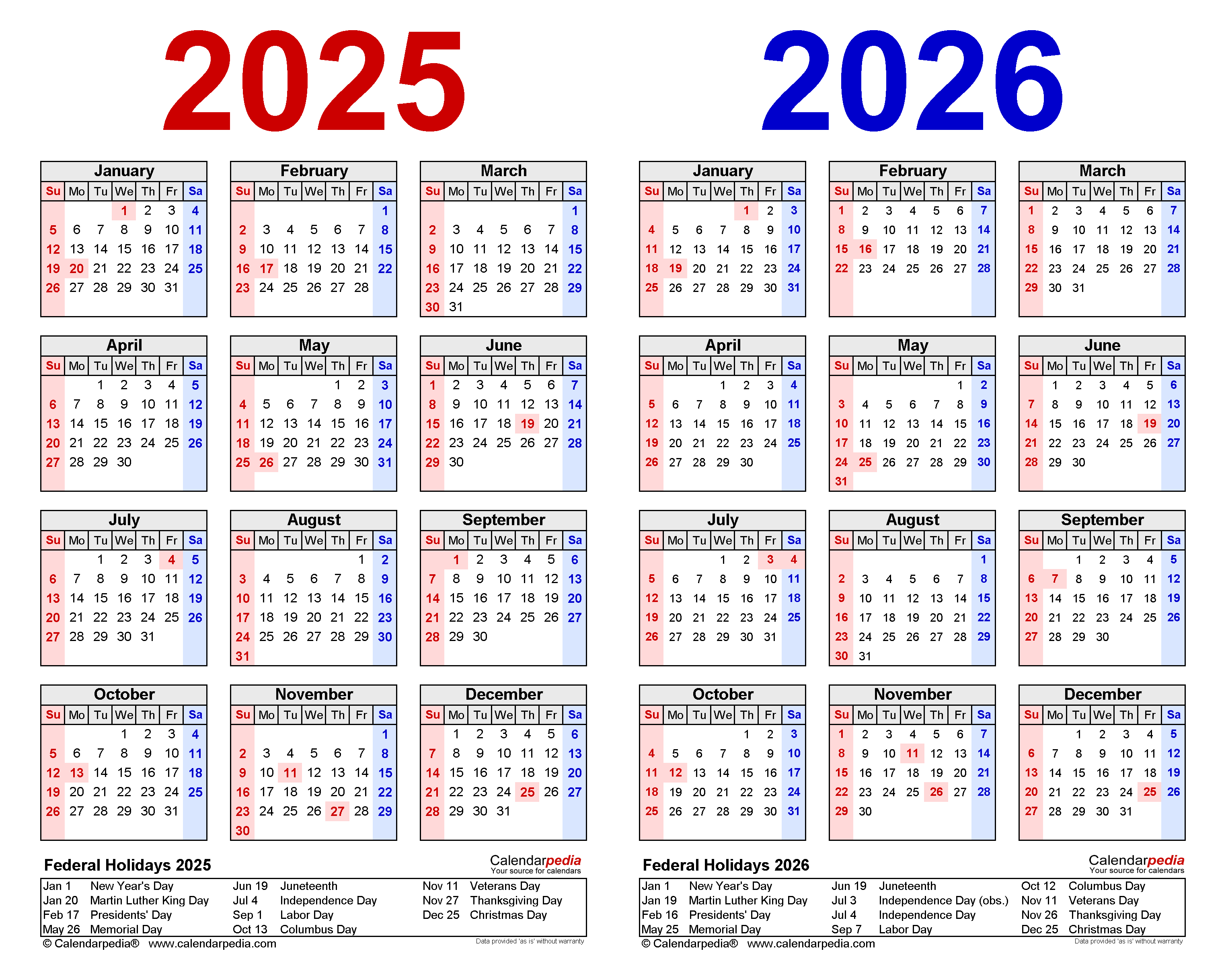

Calendar for Implementation of IPSAS 204, 205, and 206

The following calendar provides a summary of the key dates for the implementation of IPSAS 204, 205, and 206:

- January 1, 2025: IPSAS 204, 205, and 206 become effective for periods beginning on or after this date.

- December 31, 2024: Entities should begin to apply IPSAS 204, 205, and 206 to their financial statements for the year ending on this date.

- June 30, 2025: Entities should have completed the implementation of IPSAS 204, 205, and 206 by this date.

Impact of IPSAS 204, 205, and 206

The implementation of IPSAS 204, 205, and 206 will have a significant impact on the way that public sector entities prepare and present their financial statements. These IPSASs will require public sector entities to:

- Adopt the accrual basis of accounting.

- Adopt the going concern basis of accounting.

- Adopt the single entity approach.

- Prepare financial statements on a comparative basis.

- Prepare notes that provide additional information about the entity’s financial position and performance.

Resources for Implementing IPSAS 204, 205, and 206

The IPSASB has developed a number of resources to help public sector entities implement IPSAS 204, 205, and 206. These resources include:

- A transition guide that provides guidance on the changes that will be required to implement IPSAS 204, 205, and 206.

- A series of webinars that provide an overview of IPSAS 204, 205, and 206.

- A library of frequently asked questions (FAQs) that provide answers to common questions about IPSAS 204, 205, and 206.

Conclusion

IPSAS 204, 205, and 206 are three new IPSASs that will have a significant impact on the way that public sector entities prepare and present their financial statements. Public sector entities should begin to prepare for the implementation of these IPSASs as soon as possible.

Closure

Thus, we hope this article has provided valuable insights into IPSD 204, 205, and 206: Calendar for 2025 and 2026. We thank you for taking the time to read this article. See you in our next article!