The Master Treasury Bills Calendar: A Comprehensive Guide

Related Articles: The Master Treasury Bills Calendar: A Comprehensive Guide

- NYC DOE School Calendar 2025-2026: A Comprehensive Overview

- Calendario 2025 Junio

- Excel 2025-2026 Calendar: A Comprehensive Guide

- Calendário 2025 Outubro

- 2025 Indonesian Lunar Calendar

Introduction

In this auspicious occasion, we are delighted to delve into the intriguing topic related to The Master Treasury Bills Calendar: A Comprehensive Guide. Let’s weave interesting information and offer fresh perspectives to the readers.

Table of Content

Video about The Master Treasury Bills Calendar: A Comprehensive Guide

The Master Treasury Bills Calendar: A Comprehensive Guide

Introduction

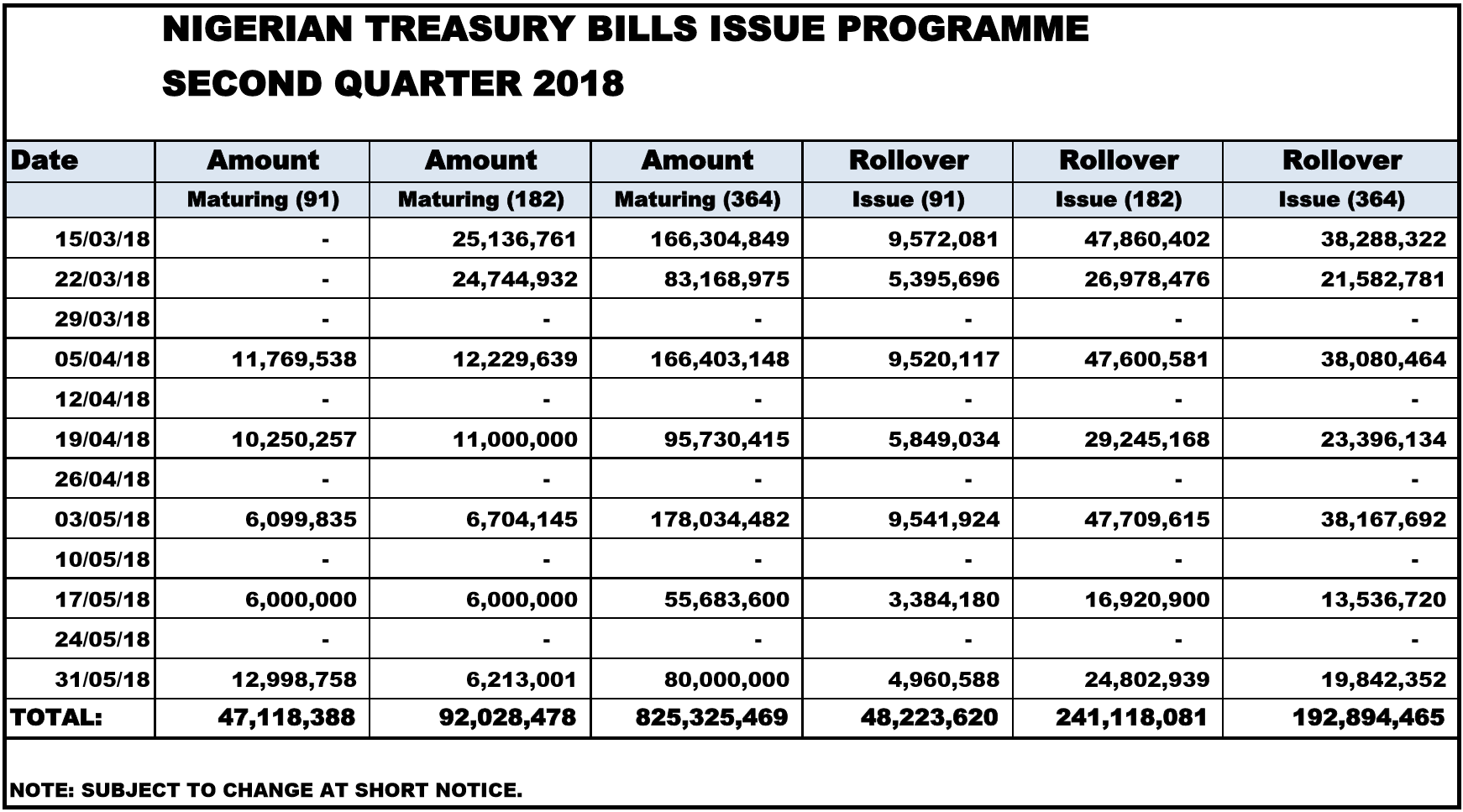

The Master Treasury Bills Calendar is a comprehensive schedule of all Treasury bills (T-bills) that the U.S. Department of the Treasury plans to issue over the next 12 months. It is an essential tool for investors, traders, and financial institutions that need to plan their cash flow and investment strategies.

What is a Treasury Bill?

A Treasury bill is a short-term debt obligation issued by the U.S. government. T-bills have maturities of 4 weeks, 8 weeks, 13 weeks, 26 weeks, and 52 weeks. They are sold at a discount from face value and mature at par. The difference between the purchase price and the maturity value represents the interest earned by the investor.

The Master Treasury Bills Calendar

The Master Treasury Bills Calendar is published monthly by the Treasury Department’s Bureau of the Fiscal Service. It provides the following information for each T-bill auction:

- Auction date

- Maturity date

- Amount to be auctioned

- CUSIP number

- Settlement date

- Minimum bid

- Maximum bid

How to Use the Master Treasury Bills Calendar

Investors can use the Master Treasury Bills Calendar to:

- Plan their cash flow by identifying when T-bills will mature and how much cash will be available.

- Time their investments by purchasing T-bills with maturities that align with their financial goals.

- Compare the yields on different T-bills to determine which ones offer the best return.

- Identify potential trading opportunities by tracking the movement of T-bill yields over time.

Types of T-Bill Auctions

There are two types of T-bill auctions:

- Competitive auctions: In competitive auctions, investors submit bids for a specific amount of T-bills at a specific yield. The Treasury Department awards the T-bills to the investors who submit the highest bids.

- Non-competitive auctions: In non-competitive auctions, investors simply submit a request to purchase T-bills without specifying a yield. The Treasury Department awards the T-bills to all investors who submit requests, regardless of the yield they bid.

How to Participate in a T-Bill Auction

Investors can participate in T-bill auctions through a broker or dealer. The minimum bid for a T-bill is $1,000.

Settlement

T-bills settle on the business day following the auction. Investors receive payment for the T-bills they purchase and the T-bills are credited to their accounts.

Secondary Market

T-bills can be traded in the secondary market after they have been issued. The secondary market provides investors with liquidity and allows them to buy and sell T-bills at any time.

Benefits of Investing in T-Bills

T-bills offer a number of benefits to investors, including:

- Safety: T-bills are backed by the full faith and credit of the U.S. government, making them one of the safest investments available.

- Liquidity: T-bills can be easily traded in the secondary market, providing investors with access to their cash when they need it.

- Low risk: T-bills have very low interest rate risk because their maturities are so short.

- Tax advantages: T-bills are exempt from state and local income taxes, making them an attractive investment for high-income earners.

Conclusion

The Master Treasury Bills Calendar is a valuable tool for investors, traders, and financial institutions that need to plan their cash flow and investment strategies. By understanding how to use the calendar, investors can make informed decisions about when to buy and sell T-bills and how to maximize their returns.

:max_bytes(150000):strip_icc()/treasurynotes-bills-and-bonds-3305609-finalv42-fc941b4ff55d4247951067ef742a406b.png)

Closure

Thus, we hope this article has provided valuable insights into The Master Treasury Bills Calendar: A Comprehensive Guide. We hope you find this article informative and beneficial. See you in our next article!